Until now, taxpayers have had three options for resolving their IRS back taxes: 1. You can hire a tax lawyer … ...

According to Google, this year’s hot Halloween costumes include Wonder Woman, Cruella DeVil, and Forky from “Toy Story 4.” Your ...

If there’s one thing football season reminds us each year, it’s that a coach can make or break their team’s ...

Dealing with the IRS can be a nerve-racking and painstaking process for taxpayers. The Tax Code is so complicated that ...

Don’t Let the IRS Put the Haunt on You: The Not-So-Scary Truth About Tax Relief Imagine getting a letter from ...

Here are five serious mistakes for taxpayers to avoid when it comes to back tax: Mistake No. 1: Delaying to ...

You may hear the term “IRS tax relief,” but do you know what it means? The truth is that IRS ...

Recently, Landmark has hit an enormous milestone for our company: reaching $100,000,000 in resolved back taxes! I’m excited about this ...

The IRS is reopening July 15, which means 2019 tax returns and payments are due. The IRS will resume enforcement, ...

Though the IRS is usually an additional source of stress, they’re working on ways to ensure they’re a source of ...

At Landmark Tax Group, we’re always excited to highlight our clients’ IRS success stories! This one was especially stressful for ...

As I write this, many of us are adjusting to a new “normal”: working from home, managing education for our ...

You’ve heard the commercials proclaiming, “We solve your tax problems for pennies on the dollar!” But as the saying goes, ...

Right now, there is a lot on everyone’s mind, like managing your children’s online education, making grocery runs, and monitoring ...

Life happens, so you need to be prepared for how major changes will affect both your well-being and your bottom ...

Is The IRS Piling On Debt? We might be in spring, but when the IRS knocks on your door, it ...

Another tax season has come and gone. But for those who still owe money, it can feel like finishing a ...

What You Need to Know About the IRS Any interaction with the IRS can leave you with a pit in ...

Essential Questions for a Tax Relief Firm When dealing with the IRS in any capacity make sure you’re getting the ...

During the holidays, so many different activities will grab your attention: family dinners, Christmas shopping, decorating and more. It’s hard ...

When the IRS comes to collect, it can be an anxiety-inducing experience from start to finish, but it’s important to ...

Our clients go through a lot when working with the IRS, and periodically, we like to showcase the progress they ...

When I was a field agent for the IRS, I never went into the field over the holidays, especially during ...

Handling the IRS can be like being in a bad horror movie: too many jump-scares and losing yourself in the ...

Hey, everyone! Occasionally we like to highlight recently resolved cases, and we couldn’t be happier for this particular client! Coming ...

When life happens and you get a collection notice from the IRS, those butterflies in your stomach could turn into ...

Recently the IRS released a roadmap of the Taxpayer Journey through the IRS. Here’s what it looks like: Click here ...

At Landmark Tax Group, we’re always eager to showcase any client who has reached an appealing settlement with the IRS! ...

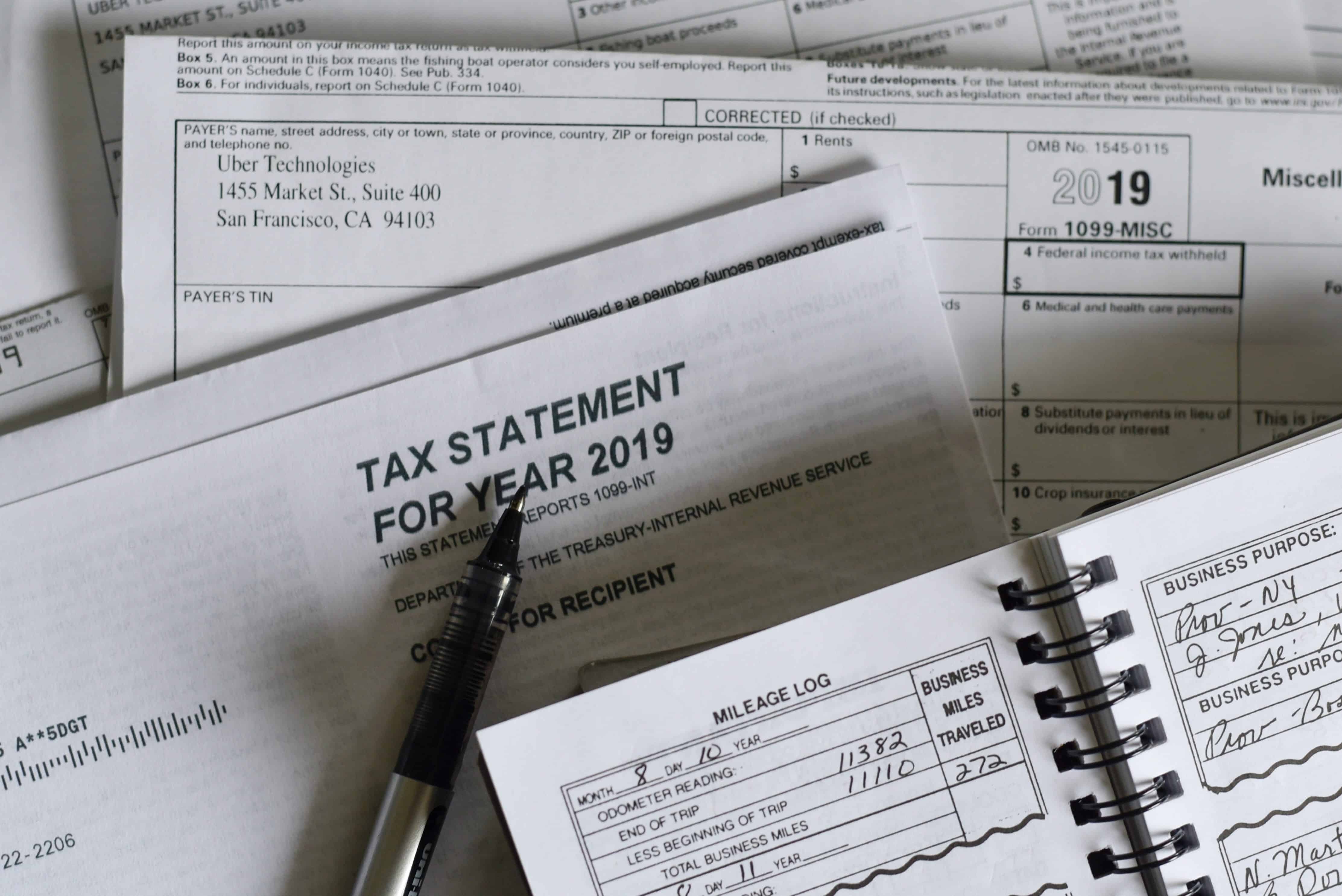

Recently a client came to us with four years of overdue IRS tax returns, totaling $130,601 in back taxes, interest ...

When I first started Landmark Tax Group, I told my wife Hanna that I was going to break into a ...

If you’ve vowed to improve your health in 2019, you may be ramping up your workouts, trying to make spinach ...

Taxpayers are often confused about the difference between an IRS tax lien and an IRS tax levy. Both are a ...

The Type of Business You Operate Determines the Taxes You Must Pay In the United States, there are nearly 28 ...