What is an IRS CP504 Tax Notice Letter and How To Respond

IRS Notice CP504 – What Does It Really Mean?

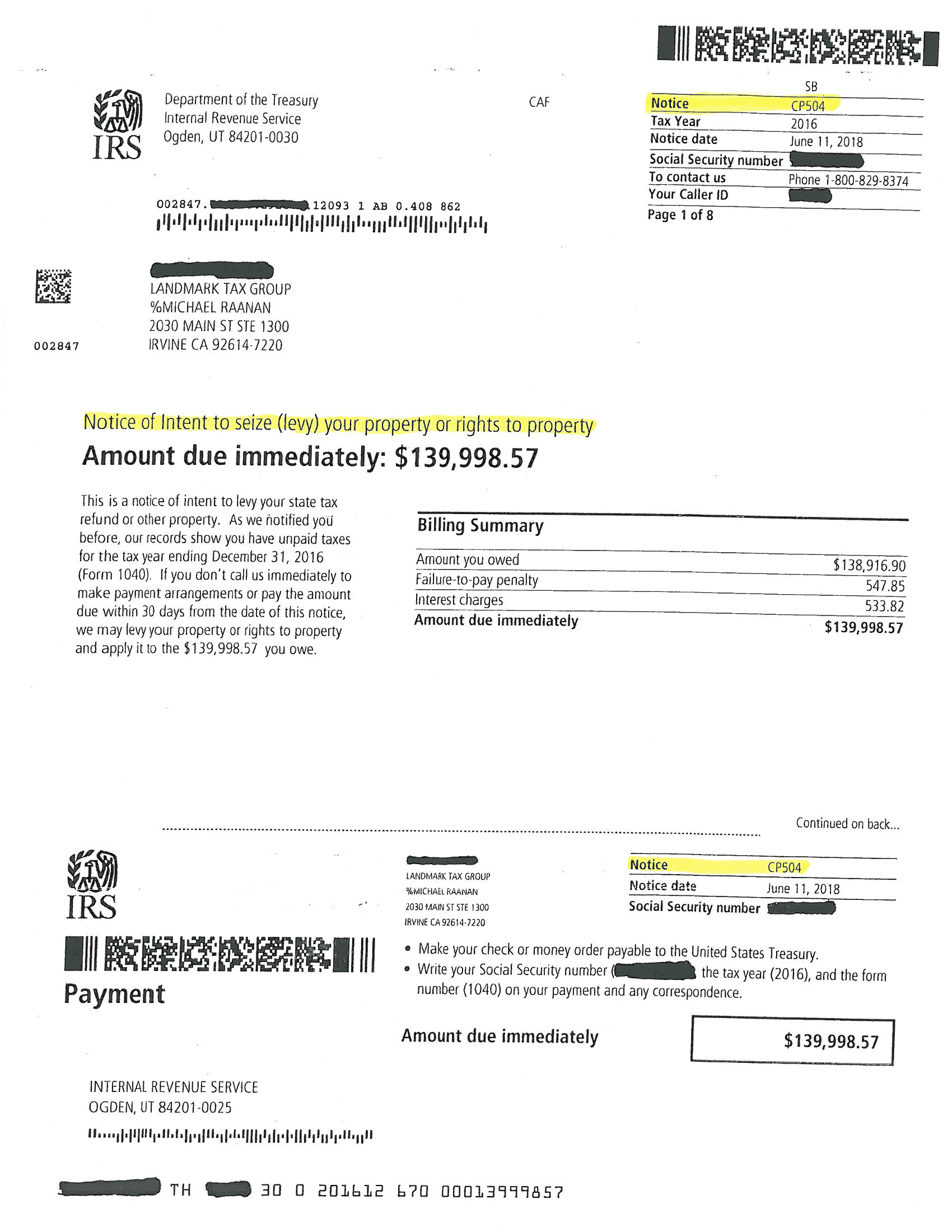

Every year, the IRS sends out millions of tax bills to taxpayers around the country. The agency is required to put taxpayers on notice about their back taxes. They must give them an opportunity to respond before any enforcement action is taken. Initially in the Collection Process, taxpayers may receive a Notice CP14 from the IRS. However, if there is no response or the tax debt has not been fully resolved, the IRS will issue a Notice CP504 Notice of Intent to Seize (Levy) Your Property or Rights to Property.

CP504 Certified Mail – How To Pay Online

Typically, the IRS will send you a CP504 Notice via Certified Mail. To meet strict requirements under the tax law, the agency has to mail the letter to your “last known address”. This is usually the mailing address listed on your last tax return.

The Notice states: “If you don’t call us immediately to make payment arrangements or pay the amount due within 30 days from the date of this notice, we may levy your property or rights to property and apply it to the tax you owe.”

For taxpayers who agree with the amount due on the notice, and can full pay, the IRS provides for several ways to make a payment.

If you agree with the IRS balance, but cannot full pay the tax due, you may be able to set up an affordable installment agreement in order to pay the taxes over time. Taxpayers who receive a CP504 Letter must follow IRS rules and procedures to prevent a tax lien from being filed and levies from being issued. For guidance, and to explore if a reduction or removal of IRS penalties is possible, contact Landmark Tax Group for a no-obligation consultation.

CP504 WARNING NOTICE – WHAT IF I CAN’T PAY THE IRS

If you disagree with, or if you can’t full pay, the CP504 Notice, the IRS must be immediately contacted and informed of your position and intentions. Should the IRS fail to hear from you or your Tax Representative, the agency is mandated to proceed with enforced collection action, including filing tax liens, issuing bank levies, garnishing your wages, and seizing your valuable assets. The IRS is also required to assess penalties and interest against you for the unpaid tax. See 10 Ways to Get IRS Penalties Removed.

HOW TO GET HELP WITH IRS NOTICE

Since the CP504 Notice requires a quick response, you will need to determine if the taxes can be fully paid. If not, it’s vitally important to get tax help right away from a licensed and experienced Tax Representative to ensure the IRS does not take enforcement action against you. The IRS needs to be informed in a timely manner that you will be making arrangements to pay your tax debt under the guidelines and criteria made available by the Tax Code. If you’re unable to full pay your tax debt, you’ll need help setting up an affordable payment plan, filing for a tax settlement (aka offer-in-compromise), or requesting a reduction of penalties.

For a FREE review of your CP504 Notice, fax or email your notice to us here. We will also provide a consultation by phone if you contact us within 30 days of the notice date.

See: 5 Practical Ways to Deal With IRS Back Taxes

See: Our Results

For immediate assistance with your IRS matter use our Contact Form for a CONFIDENTIAL consultation with our licensed Tax Relief specialists and former IRS Agents. We look forward to serving you.