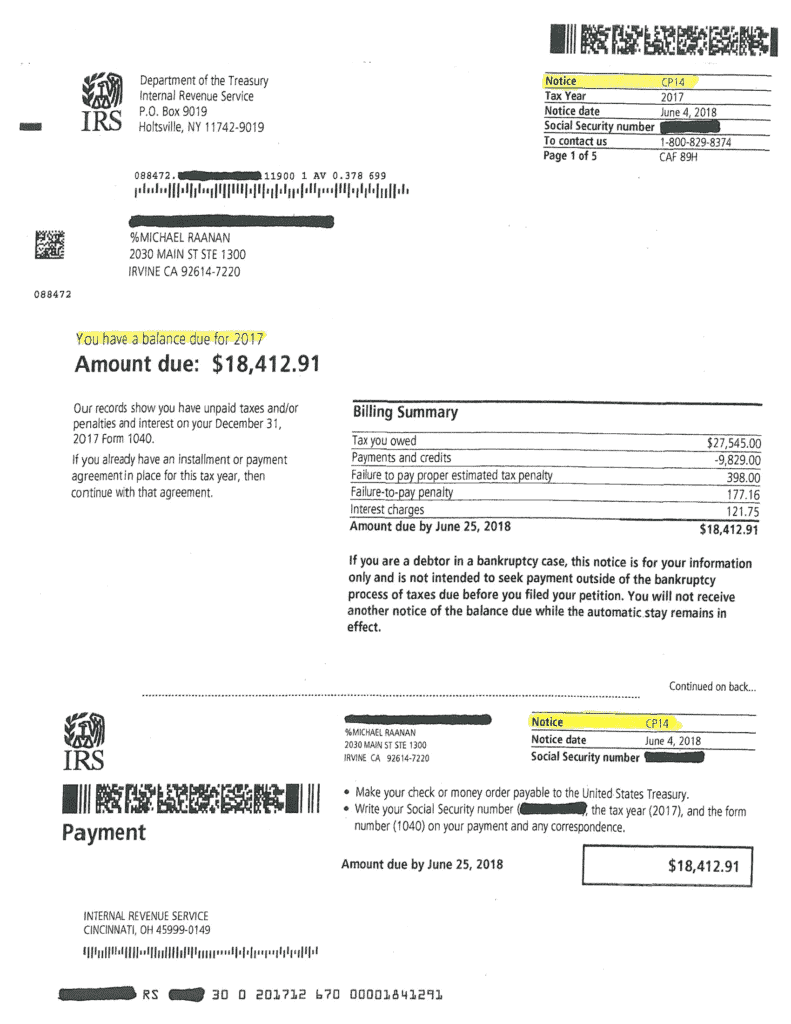

The IRS mails out a CP14 Notice to notify taxpayers of a balance due. The notice is systemically generated by the IRS computers and mailed to millions of taxpayers throughout the year. Following tax season every year, there is a surge in the number of CP14 notices sent out by the IRS. If you’ve received this notice, you are most likely in the beginning stages of the IRS Collection Process.

As mentioned above, a CP14 notice is sent by the IRS when you owe money on unpaid taxes. Taxpayers must pay the amount listed on the notice by the date listed. If you agree with the amount stated, and can full pay, the IRS provides for several ways to make a payment.

If you agree with the IRS balance, but cannot full pay the taxes due, you may be able to set up a payment plan or installment agreement in order to pay the taxes over time. To ensure your payment plan is affordable for you, to prevent a tax lien, and to explore if IRS penalties can be removed or reduced, contact Landmark Tax Group for guidance and a consultation.

If you cannot pay, or if you disagree with, the CP 14 Notice, the IRS needs to be contacted right away to address the tax balance. If the IRS doesn’t hear from you or your Tax Representative, they are required to move forward with the IRS Collection Process and begin enforcement action, including issuing tax liens, bank levies, wage garnishments, and seizure of assets. The IRS is also required to charge penalties and interest on the unpaid tax. See 10 Ways to Get IRS Penalties Removed.

Since the CP14 Notice requires a timely response, you will need to determine if you can full pay the tax liability. If you cannot, it’s important to get professional tax help right away to ensure your IRS Collection case does not escalate and move towards enforced collection. The IRS needs to know that you’re a cooperative taxpayer and that you just don’t have the financial means to full pay at this time. It’s possible you may need a payment plan, an offer-in-compromise, or a penalty reduction to help you resolve the back taxes. For a FREE review of your CP14 Notice, fax or email your notice to us. We will also provide a consultation by phone if you contact us within 30 days of the notice date.

See: 5 Practical Ways to Deal With IRS Back Taxes

See: Our Results

For immediate assistance with your IRS matter, use our Contact Form or call us at 1-949-260-4770 for a CONFIDENTIAL consultation with our licensed Tax Relief Specialists and former IRS Agents.

We look forward to serving you.