PRO TIP: Instead of paying $10,000 in fees for “tax relief”, save money and time by using an IRS Strategy Session!

Instead of paying $10,000+ for tax representation, anyone who owes back taxes to the IRS or State of California should reserve their IRS Tax Case Strategy Session to receive one-on-one, detailed, and customized expert guidance on how to resolve their tax problem. Why pay more for a Tax Representative when you can effectively resolve your tax problem on your own after some expert guidance?

We can help you with any and all back tax issues related to the IRS or State of California Franchise Tax Board (FTB) including: payment plans, financial hardships, penalties and interest, tax liens, levies, offers-in-compromise, tax settlements, appeals and more.

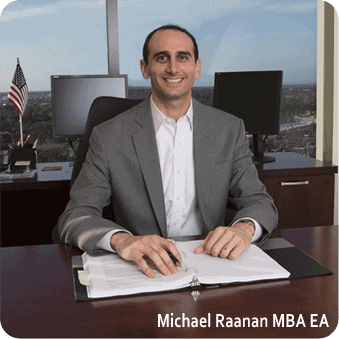

You will speak directly with Michael Raanan, MBA, EA, who is an IRS-licensed Tax Relief Specialist, Enrolled Agent and former IRS Agent. While working over 18 years at the IRS and in private practice helping taxpayers like you, he has personally resolved thousands of back tax cases and settled over $400,000,000 in taxes. See below for more on Michael’s background.

Once you sign up, you’ll immediately receive a “Welcome” email so we can schedule your Strategy Session and start helping you right away. Your “Welcome” email will also include two helpful Special Reports which will provide you with immediate insight into resolving your tax matter.

We accept PayPal and all major credit cards including Visa, MasterCard, American Express and Discover. Click on Reserve My IRS Tax Case Strategy Session now to get started.

Yes! – Your payment options include:

Pay in Full – make a full payment today using PayPal or all major credit cards.

Pay Later – simply sign up now and pay later, up to 36 months! This allows you to get help now, without delay!

To use the “Pay Later” option:

1. Click on the button that says “Reserve My IRS Strategy Session”

2. Fill out your information

3. Select “Klarna” at the bottom of the screen. This will allow you to buy now and pay later.

4. Click the button that says “Place Order”. You will then see options to buy now and pay later, up to 36 months!

President, Landmark Tax Group Licensed Enrolled Agent Former IRS Agent With a Master’s Degree in Business Administration (MBA) from the University of Phoenix (UofP) and a Bachelor’s Degree in Business from Florida State (FSU), Michael also holds a federal license in good standing directly from the Internal Revenue Service (IRS) as an Enrolled Agent. He is the founder and President of Landmark Tax Group with 18 years experience successfully resolving IRS concerns for literally thousands of tax relief clients throughout California and across the country. The Enrolled Agent License is the highest credential the IRS awards to tax professionals. It gives Michael and Landmark Tax Group the authority to represent taxpayers nationwide. The IRS refers to an Enrolled Agent as having “Elite Status.” Those who earn this status “have unlimited practice rights” and “are unrestricted as to which taxpayers they can represent, what types of tax matters they handle, and which IRS offices they can represent clients before.” [ Source: IRS ] Learn more about Michael.

“After calling the other highly advertised tax assistant agencies and being disappointed with how they responded to my tax matter, I feel fortunate to have found out about the Landmark Tax Group. Michael was very understanding of my situation, and I felt very comfortable dealing with him. He was very knowledgeable and professional in handling our tax issue in a timely manner. I would highly recommend The Landmark Tax Group to anyone who needs assistance in dealing with the IRS.” – Chip P., Walnut, Irvine, CA

“Wow, just wow. I called Michael today to ask about some major tax issues I had with a defunct corporation I’d started years ago. Michael talked to me for about half an hour, walking me through options and generally helping me understand my options. Because of him, I’m going to rest nicely tonight for the first time in weeks. It was great to hear that he used to work in IRS collections for 8 years too… which made me feel a lot more secure in his answer. In all, I’m completely stunned by the level of service he gave to a random stranger who called in and wasn’t going to turn into any revenue for him. I have to imagine that his level of service for actual customers is unreal.” – Garrett D., Dublin, OH

“On April 10, 2016 I received my tax return from the CPA and PANIC set in. I got that queasy feeling in my gut, broke into a sweat and felt light headed. I owe how much? OMG! You have got to be kidding me! As I scoured the web looking for help I came across several Tax Help firms and after calling a few I thought I was really in trouble. All I was getting was hype and sales talk and I was very concerned. I was about to give up when I saw a listing for Landmark Tax Group, read a short blurb and was inspired. I called but it was after hours so I sent an email of desperation. To my surprise, Michael Raanan answered my email within just a few minutes and gave me a number to reach him directly. He was the calm voice of reason that I needed to hear, I was able to sleep that night just fine. Over the course of the next 4 months he took the time to educate me on the IRS, the tax code and the Law. He answered each and every question, calmed me down when I was upset and never once gave me the impression he was anything but a professional who truly cares. I was not and am still not happy about the tax bill I have to pay, but Michael helped ease the pain by showing me how to use the law to my benefit resulting in me saving money, time and frustration. I am able to pay my debt via installments over a long period of time at a payment I asked for and I never had to personally speak with anyone at the IRS. In the end, I have peace of mind knowing I won’t have to worry anymore about tax debt. This group is the best of the best, true professionals, folks I will keep on my Rolodex. If you need tax help do yourself a favor and put your trust in Michael and the Landmark Tax Group. You’ll sleep like a baby. Thanks again Michael, you are indeed the best.” – Walt F., Charlotte, NC

“Michael Raanan represents the highest level of professionalism, integrity, decency, and true concern for his clients. His advice every step of the way was right on target. The end result was a savings of $13,000 on my taxes. I have already referred him to the other members of my financial team and have complete confidence in referring any clients to him. He is a shining star in his field. Oh, did I mention how reasonable his fees are? Exceptional considering the amount of attention he provides.” – Marilyn J., Los Angeles, CA

“We got really lucky when we found Michael Raanan of Landmark Tax Group. We had heard of ‘Fresh Start’ on the radio and I ‘thought’ I could take on the IRS myself with filling out some forms. I was sadly mistaken. I couldn’t find any help online and then I got referred to Michael. We never met in person because he informed me we could do everything via phone and email but was fine to meet with me if I wanted to. He always answered my calls or returned them promptly. Everything was so seamless and easy. He was able to get some penalties and interest abated for us that I would have never been able to do. He was able to wipe away $4,000-$4,500 of what we owed the IRS. He has a way of explaining things so simply and is very patient in explaining even if he had to repeat himself!! The entire process took 1 1/2 years only because the IRS is way behind, but he was always on top of any pressing matter. A true professional in every sense of the word. Please feel safe with him for your taxes.” – Kasia M., Coto de Caza, CA