How we prevented wage garnishment and home seizure for a client

Hey, everyone! Occasionally we like to highlight recently resolved cases, and we couldn’t be happier for this particular client!

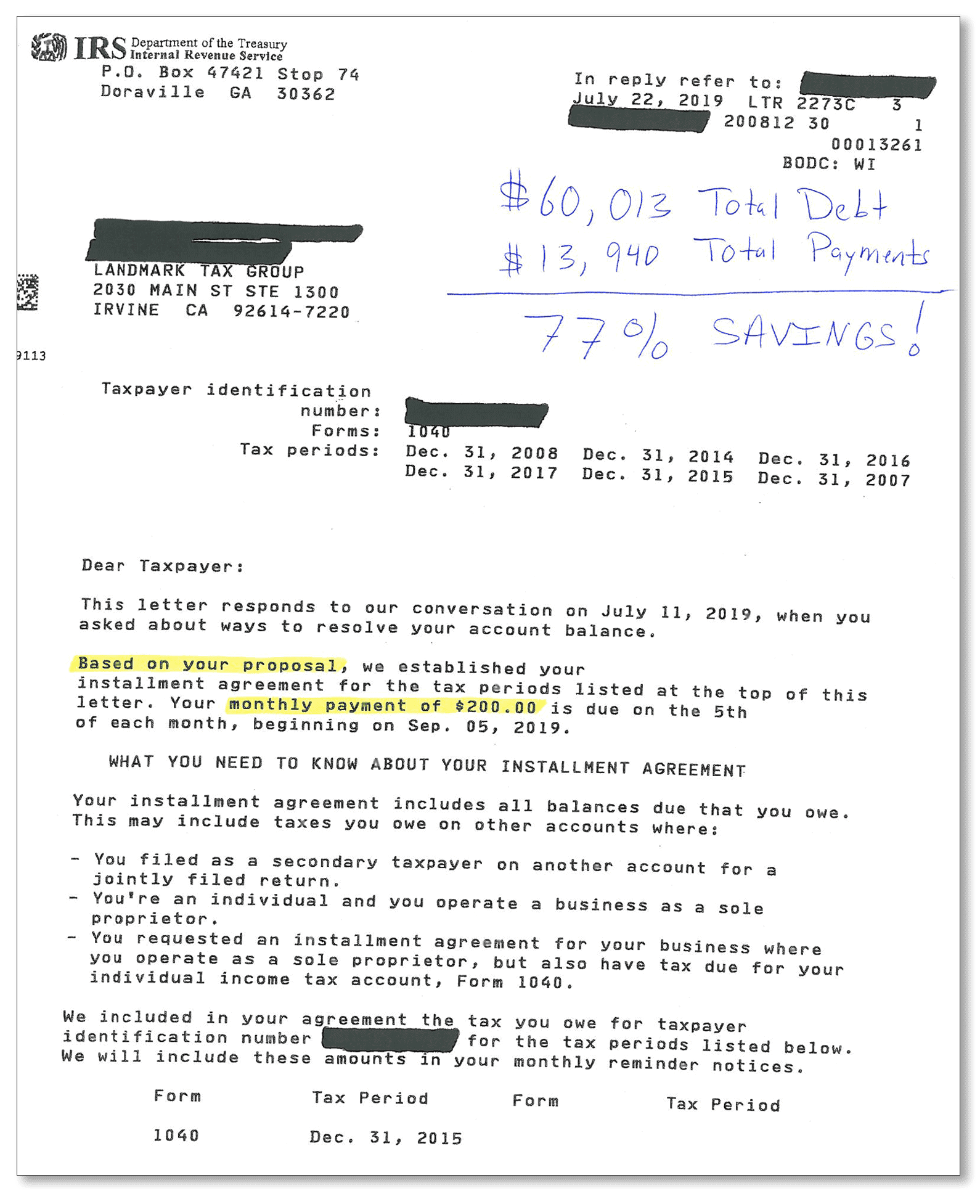

Coming into the case, our client had an IRS tax debt of $60,013. After we worked with the client on their case, they now only have to pay $13,940 using a $200-per-month installment plan. For the client, that’s a savings of $46,073, or 77% — a settlement of just 23%!

What makes it better is the fact that this client’s home and retirement accounts were fully protected. We were able to prevent all bank levies and wage garnishments for the client, as well. Here’s the official IRS document (click to see a larger version):

With a wage garnishment, the IRS can actually collect your wages without first getting a judgment to do so. What makes situations like this even more troublesome is that the IRS can take more than most creditors are allowed. Federal law allows them to take up to 25% of your disposable income. The silver lining is that the IRS has several options to address your debt before they attempt to garnish any of your wages.

If you have any questions regarding bank levies or wage garnishments, reach out to us at any time. We would love to help you reduce your tax debt today!