How $482,674 in IRS Back Taxes Required Zero Payments

Landmark Tax Group would like to congratulate its client who no longer needs to pay $482,674 in back taxes to the IRS!

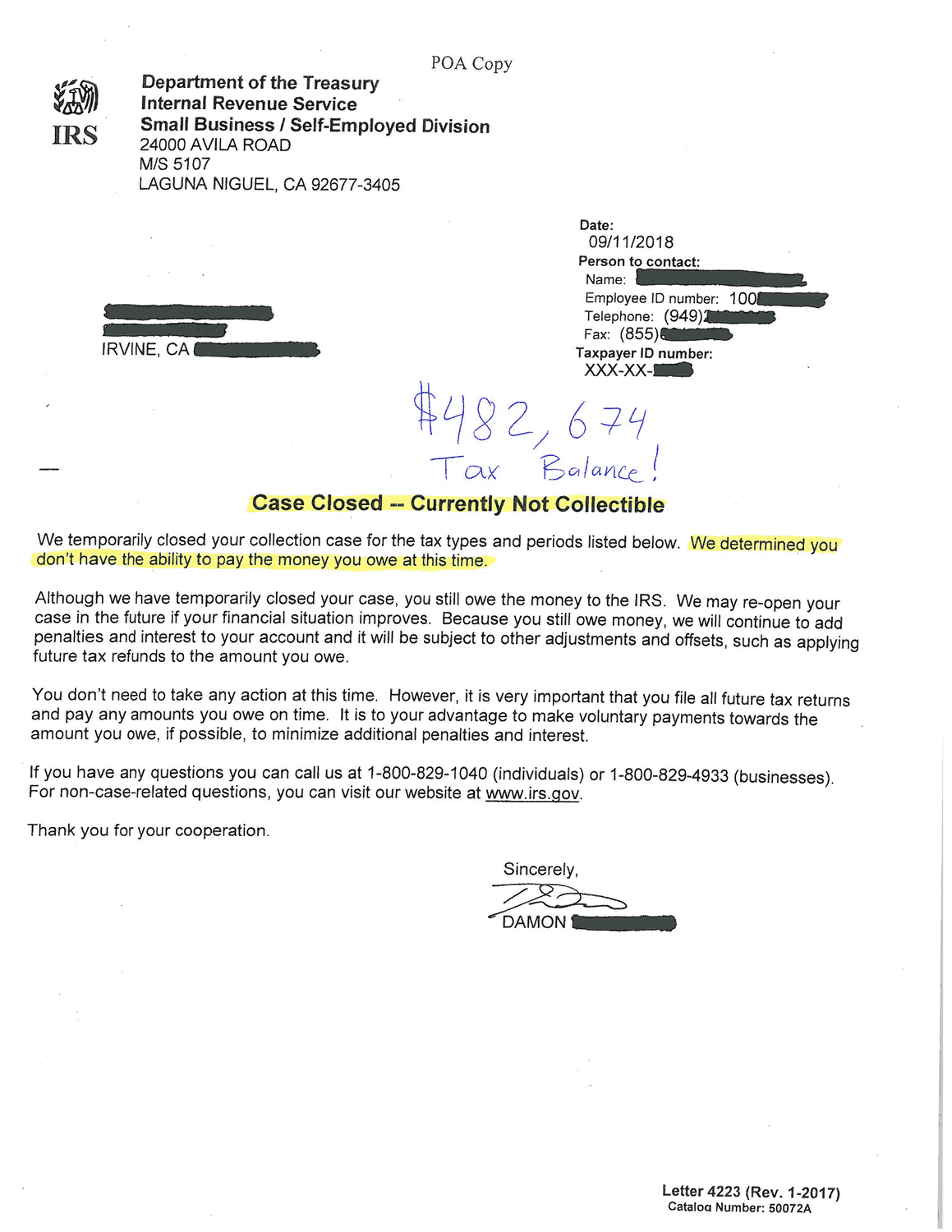

Tax Debt: $482,674 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Prevention of tax levies, obtained Currently-Not-Collectible (financial hardship) settlement. No payment required!

See the official IRS Approval Letter below:

Click here to see more of our recent Case Results.

Do you, or a client of yours, owe the IRS?

Landmark Tax Group is a professional tax resolution firm that specializes exclusively in IRS and State back tax issues. Not only are we licensed Tax Relief Specialists, we are also former Senior IRS Agents who now serve the best interests of taxpayers like you – all we do is handle IRS and State Tax Relief matters, all day, every day.

If you owe back taxes and would like Landmark Tax Group to review your tax case for FREE, please contact us now for a complimentary consultation. Speak directly to our former IRS Agents for free at (949) 260-4770.