Despite its vast power and authority, the IRS is, in fact, bound by certain rules. Those rules are written in the Tax Code, aka the Internal Revenue Code.

Among the many rules, lies the Collection Statute Expiration Date (CSED), which limits the IRS to a 10-year window by which the agency can collect a tax debt from a taxpayer.

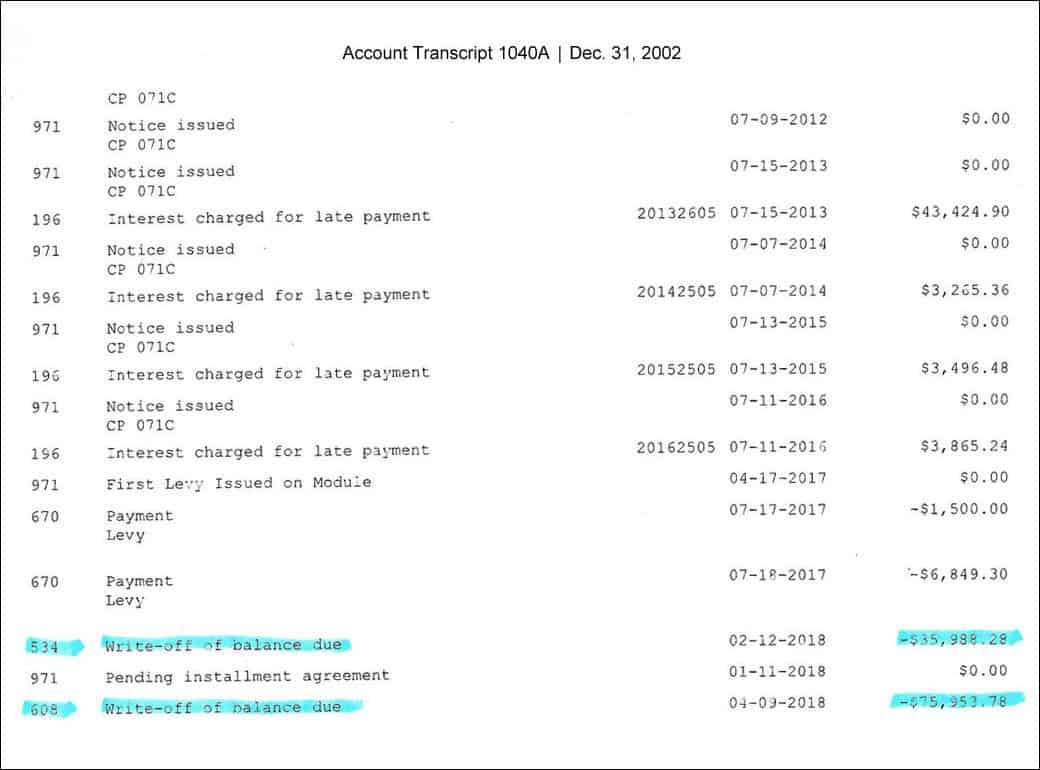

In the example below, one of Landmark Tax Group’s clients owed over $112,000 in taxes on a 2002 tax period. As you can see from the transcript, the taxpayer had two separate assessments, both of which have recently expired.