The IRS sends out millions of tax bills every year to taxpayers everywhere. The IRS is required to give taxpayers notice of their owed back taxes and provide a chance to respond before any enforcement action is taken. At first, you may receive Notice CP14 first and then Notice CP504 Notice of Intent to Seize (Levy) Your Property or Rights to Property. If the IRS doesn’t hear from you, they may send you the final IRS CP90 Tax Notice of intent to levy your property. Levies can include paychecks, bank accounts, and state income tax refunds, etc.

Generally, the IRS will send you a CP90 Notice through Certified Mail. They must meet strict requirements under tax law, and send the notice to your “last known address”. The address used is the last mailing address listed on your tax returns.

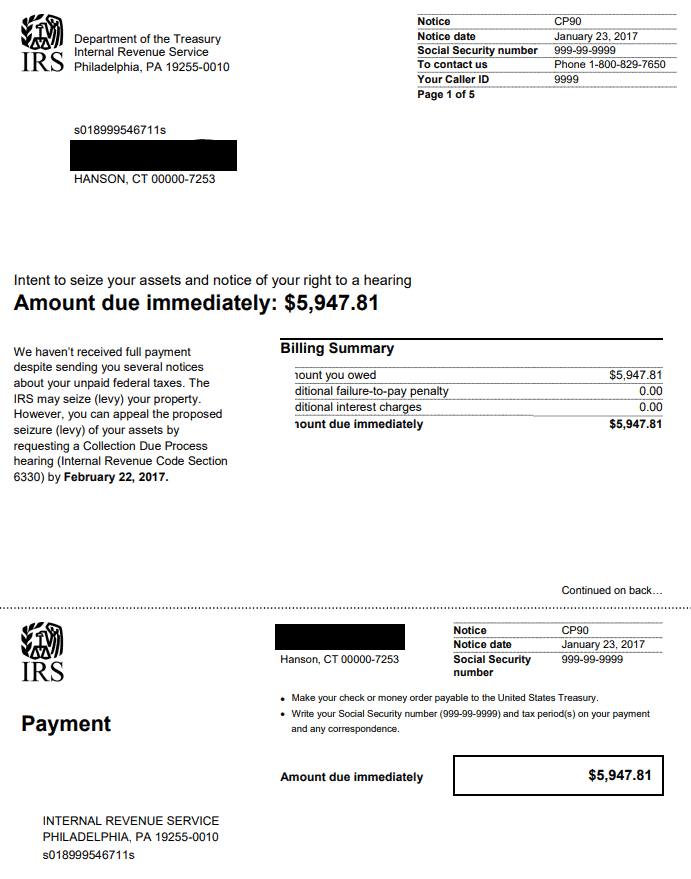

The Notice states: “We haven’t received full payment despite sending you several notices about your unpaid federal taxes. The IRS may seize (levy) your property. However, you can appeal the proposed seizure (levy) of your assets by requesting a Collection Due Process hearing (Internal Revenue Code Section 6330) by 2026.”

For taxpayers who agree with the amount due on the notice and can fully pay, the IRS provides several ways to make a payment.

If you can’t pay the owe amount fully but agree with the balance due, there are several options that are available for you. For example, you can set up an affordable payment plan, filing for a tax settlement (offer-in-compromise), or requesting a reduction of penalties. However, it’s crucial to respond to the IRS CP90 Tax Notice to prevent its disclosed enforcement actions. If the IRS fails to hear from you or your Tax Representative, they must proceed with enforced collection action. Enforcement action can include filing tax liens, issuing bank levies, garnishing your wages, and seizing your valuable assets.

If you disagree with the notice, you can request a Collection Due Process Hearing to appeal the intent to levy and other disagreements. We recommend talking to a professional to see if this process will benefit you before starting.

For guidance and to explore the back tax resolution options available to you, contact Landmark Tax Group for a no-obligation consultation.

The CP90 Notice requires a quick response. First, you will need to determine if you can pay the full amount due. If this option is not open to you, it’s crucial to speak with a licensed and experienced Tax Representative for further help. They can help prevent IRS enforcement actions against you.

For a FREE review of your IRS CP90 Tax Notice, fax or email your notice to us here. We provide a consultation by phone if you contact us within 30 days of the notice date.

For immediate assistance with IRS tax payments, or another tax matter, contact us now at 1-949-260-4770 for a No-obligation consultation with our licensed Tax Relief Specialists and former IRS Agents.

We look forward to serving you.