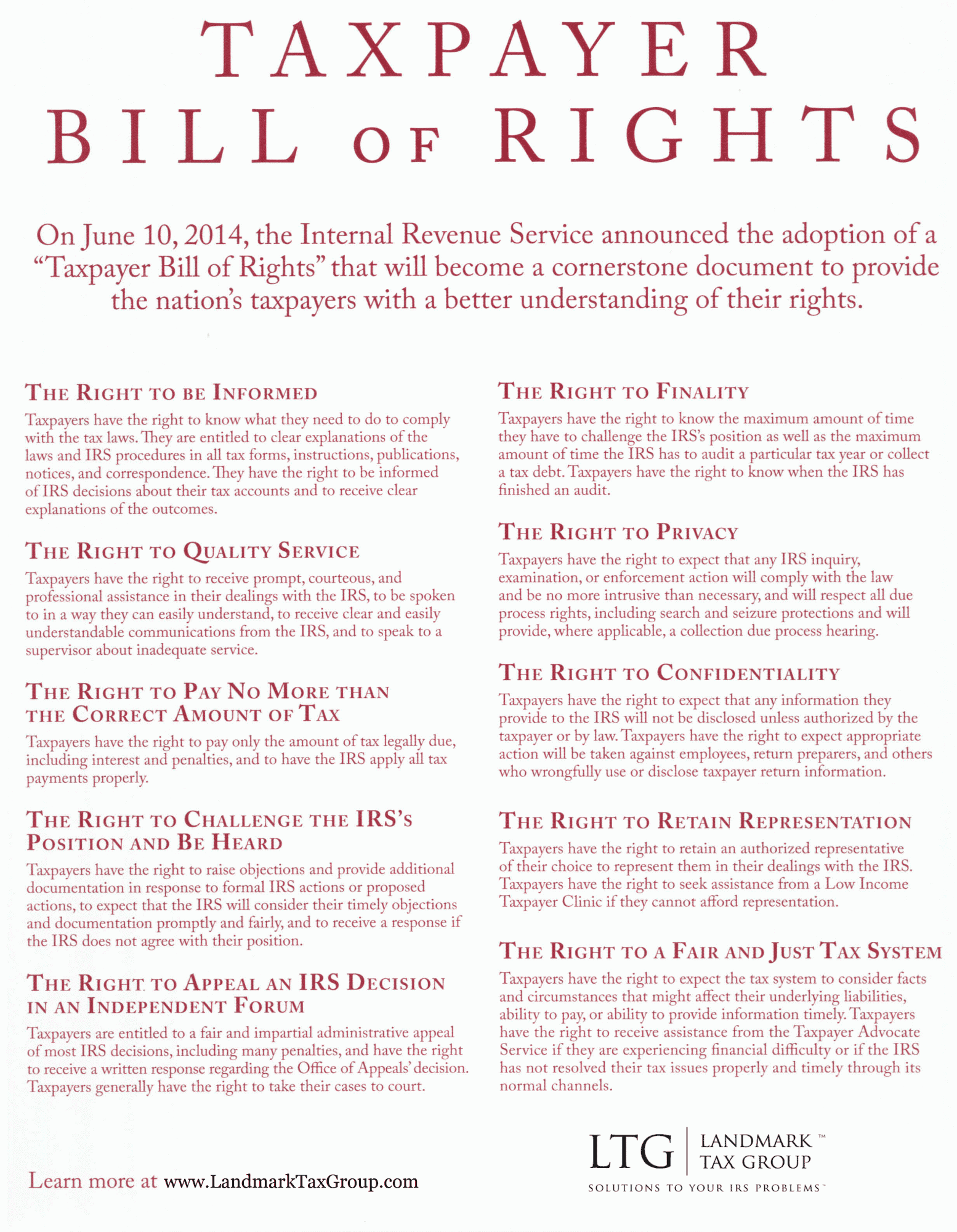

The Internal Revenue Service recently announced the adoption of a “Taxpayer Bill of Rights.” The Taxpayer Bill of Rights takes the multiple existing rights embedded in the tax code and groups them into 10 broad categories, making them more visible and easier for taxpayers to find. Similar to the U.S. Constitution’s Bill of Rights, the Taxpayer Bill of Rights contains 10 provisions.

Taxpayers have the right to know what they need to do to comply with the tax laws. They are entitled to clear explanations of the laws and IRS procedures in all tax forms, instructions, publications, notices, and correspondence. They have the right to be informed of IRS decisions about their tax accounts and to receive clear explanations of the outcomes.

Taxpayers have the right to receive prompt, courteous, and professional assistance in their dealings with the IRS, to be spoken to in a way they can easily understand, to receive clear and easily understandable communications from the IRS, and to speak to a supervisor about inadequate service.

Taxpayers have the right to pay only the amount of tax legally due, including interest and penalties, and to have the IRS apply all tax payments properly.

Taxpayers have the right to raise objections and provide additional documentation in response to formal IRS actions or proposed actions, to expect that the IRS will consider their timely objections and documentation promptly and fairly, and to receive a response if the IRS does not agree with their position.

Taxpayers are entitled to a fair and impartial administrative appeal of most IRS decisions, including many penalties, and have the right to receive a written response regarding the Office of Appeals’ decision. Taxpayers generally have the right to take their cases to court.

Taxpayers have the right to know the maximum amount of time they have to challenge the IRS’s position as well as the maximum amount of time the IRS has to audit a particular tax year or collect a tax debt. Taxpayers have the right to know when the IRS has finished an audit.

Taxpayers have the right to expect that any IRS inquiry, examination, or enforcement action will comply with the law and be no more intrusive than necessary, and will respect all due process rights, including search and seizure protections and will provide, where applicable, a collection due process hearing.

Taxpayers have the right to expect that any information they provide to the IRS will not be disclosed unless authorized by the taxpayer or by law. Taxpayers have the right to expect appropriate action will be taken against employees, return preparers, and others who wrongfully use or disclose taxpayer return information. Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. Explore your rights and our obligations to protect them.

Taxpayers have the right to retain an authorized representative of their choice to represent them in their dealings with the IRS. Taxpayers have the right to seek assistance from a Low Income Taxpayer Clinic if they cannot afford representation.

Taxpayers have the right to expect the tax system to consider facts and circumstances that might affect their underlying liabilities, ability to pay, or ability to provide information timely. Taxpayers have the right to receive assistance from the Taxpayer Advocate Service if they are experiencing financial difficulty or if the IRS has not resolved their tax issues properly and timely through its normal channels.

These rights have been incorporated into a redesigned version of Publication 1 “Your Rights as a Taxpayer”, a document that is routinely included in IRS correspondence to taxpayers.

More Tax Tips

For immediate assistance with your taxpayer’s rights, or another tax matter, contact us now at 1-949-260-4770 for a FREE consultation with our CPAs and former IRS Agents.

We look forward to serving you.